The smart Trick of Clark Wealth Partners That Nobody is Discussing

Top Guidelines Of Clark Wealth Partners

Table of ContentsGetting My Clark Wealth Partners To WorkThe Clark Wealth Partners IdeasIndicators on Clark Wealth Partners You Should KnowThe Facts About Clark Wealth Partners UncoveredThe Greatest Guide To Clark Wealth Partners

Put simply, Financial Advisors can tackle part of the obligation of rowing the watercraft that is your financial future. A Financial Advisor ought to work with you, except you. In doing so, they need to work as a Fiduciary by placing the most effective rate of interests of their customers above their own and acting in great belief while giving all relevant truths and preventing conflicts of rate of interest.Not all relationships succeed ones though. Prospective negatives of collaborating with a Monetary Expert consist of costs/fees, top quality, and possible desertion. Disadvantages: Costs/Fees This can conveniently be a favorable as long as it can be an adverse. The trick is to make certain you obtain what your spend for. The stating, "cost is a problem in the absence of value" is accurate.

Disadvantages: High Quality Not all Financial Advisors are equivalent. Simply as, not one advisor is excellent for every possible client.

Some Known Details About Clark Wealth Partners

A customer should always have the ability to answer "what occurs if something happens to my Financial Consultant?". It begins with due diligence. Constantly appropriately veterinarian any type of Financial Expert you are contemplating collaborating with. Do not count on ads, honors, credentials, and/or recommendations solely when seeking a partnership. These means can be utilized to limit the pool no question, yet then gloves require to be placed on for the remainder of the work.

when speaking with consultants. If a details area of experience is needed, such as collaborating with executive comp strategies or establishing retired life strategies for small company owners, find experts to interview that have experience in those arenas. Once a connection begins, stay purchased the connection. Working with a Financial Consultant ought to be a collaboration - financial planner in ofallon illinois.

It is this kind of initiative, both at the beginning and with the connection, which will help accentuate the benefits and ideally reduce the disadvantages. Really feel cost-free to "swipe left" several time prior to you finally "swipe right" and make a strong connection. There will be a price. The function of an Economic Expert is to assist customers develop a plan to fulfill the monetary goals.

That task consists of charges, sometimes in the types of asset monitoring fees, compensations, planning charges, financial investment product costs, etc - financial advisor st. louis. It is necessary to understand all charges and the framework in which the advisor runs. This is both the responsibility of the consultant and the customer. The Financial Advisor is in charge of providing value for the costs.

Some Known Details About Clark Wealth Partners

Preparation A organization plan is critical to the success of your service. You need it to understand where you're going, just how you're arriving, and what to do if there are bumps in the road. An excellent financial consultant can place together a detailed strategy to help you run your service extra efficiently and get ready for abnormalities that arise.

Lowered Stress As a company owner, you have great deals of points to stress about. A good monetary consultant can bring you tranquility of mind understanding that your financial resources are obtaining the interest they need and your money is being invested carefully.

Often service owners are so focused on the daily work that they shed view of the huge picture, which is to make a profit. An economic expert will certainly look at the general state of your finances without obtaining feelings included.

Clark Wealth Partners Can Be Fun For Anyone

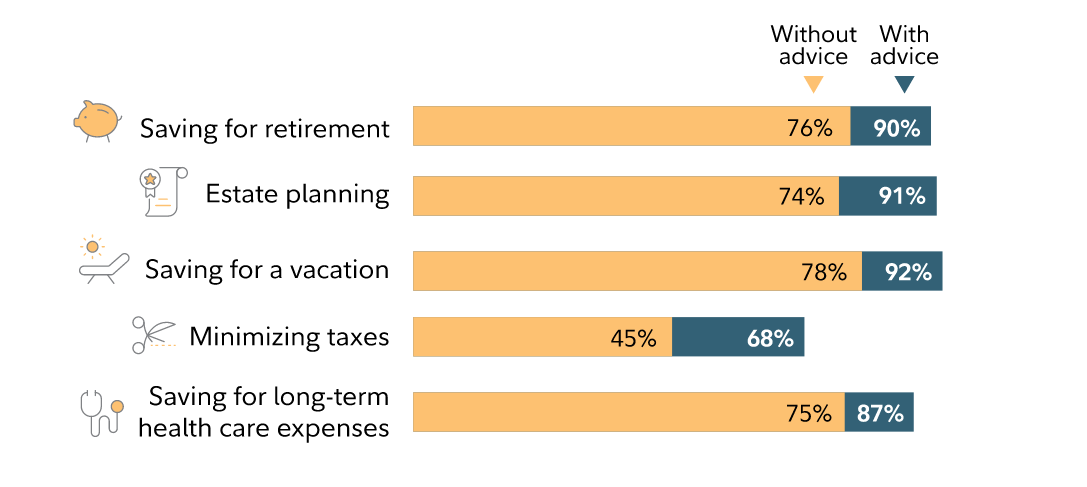

There are numerous pros and disadvantages to consider when hiring a monetary expert. Advisors deal personalized techniques customized to specific objectives, potentially leading to better economic end results.

The price of hiring a monetary expert can be significant, with fees that may affect general returns. Financial preparation can be frustrating. We advise talking with a financial advisor. This totally free tool will match you with vetted consultants who serve your location. Below's how it works:Answer a few easy questions, so we can find a match.

It just takes a few minutes. Look into the consultants' profiles, have an initial get in touch with the phone or intro personally, and select who to work with. Locate Your Expert Individuals turn to financial advisors for a myriad of factors. The prospective benefits of hiring an advisor consist of the competence and understanding they provide, the customized guidance they can provide and the lasting technique they can inject.

3 Easy Facts About Clark Wealth Partners Described

Advisors learn professionals who remain updated on market patterns, financial investment techniques and monetary guidelines. This understanding allows them to provide insights that could not be readily obvious to the typical individual - https://creativemarket.com/users/clarkwealthpt. Their competence can help you browse complex monetary situations, make notified decisions and possibly exceed what you would complete by yourself